Sunday, November 06, 2005

Articles, Charts,and Graphs, Oh My!

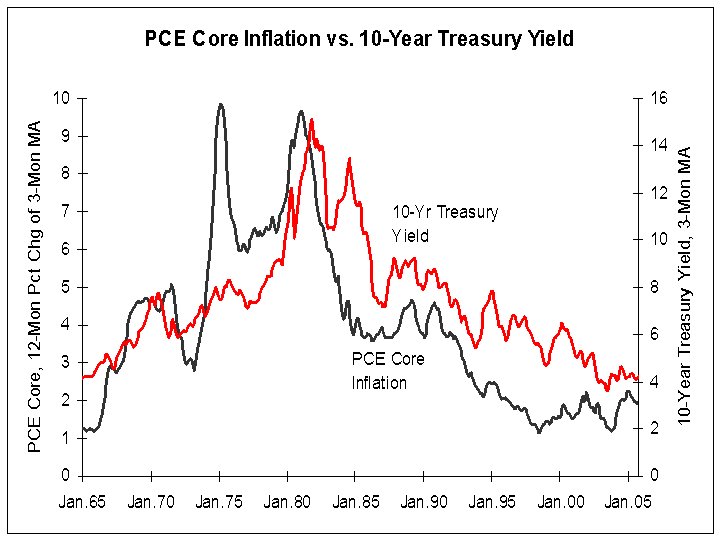

Based on the relationship of the Personal Consumption Expenditures inflation gauge and the 10-year Treasury bond, you'd think the Fed would be done! But no, they're going to keep going, raising rates until they get the long-end of the yield curve to move significantly up. Why not just issue more long-term debt and increase the supply? That would mean less short term debt, and keep the yield curve in growth mode... oh that's right, they don't want growth. (Found the image on economist Larry Kudlow's blog http://www.lkmp.blogspot.com/).

http://photos1.blogger.com/blogger/3860/605/1600/Presentation1.0.gif

Amazon.com takes publishers by the hand to lead them to the Internet age.

http://phx.corporate-ir.net/phoenix.zhtml?c=176060&p=irol-newsArticle&ID=778248&highlight=

Here's an interview about postal rates and the catalog business. There will be a lot of people claiming that the sky is falling when postal rates go up. First, they're barely keeping up with inflation, anyway. And second, postage is not the only cost, it's the cost of transaction processing that's gone down dramatically because of e-commerce. And that's the real issue. The wired audience for catalog shopping still loves print catalogs, but just in the same way, and they don't need them as often.

http://fredericksburg.com/News/FLS/2005/112005/11052005/143119

Automatic payments have now surpassed checks, according to a new MasterCard survey. This is more an issue of consolidation, since we still write checks to the credit card companies. We won't be a checkless society for quite some time, but we wll are becoming "less-check" society for years now, and that will intensify.

http://www.mastercardintl.com/cgi-bin/newsroom.cgi?id=1118&category=all

Highly recommended... Jeremy Siegel of Wharton has a marvelous book "The Future for Investors" that's loaded with discussions about worldwide economies and where they're headed (and you thought he'd just be talking about stocks). The stock investing chapters are good, too. He's on the road for Morgan Stanley, and does 90 minute presentations about all of these key trends. If you happen to be a Morgan Stanley customer, or know someone who is, get in touch with your account rep and demand to be put on the list of invitees if he comes to your area. First, you get a free book (see, I told you I've become a "frugal" New Englander); second, you get to ask questions. His newsletter is $15 a month or $150 a year.

His web site: http://www.jeremysiegel.com/

His book on amazon.com (hard copy): http://www.amazon.com/exec/obidos/tg/detail/-/140008198X/qid=1131287592/sr=8-1/ref=pd_bbs_1/103-4853314-0340604?v=glance&s=books&n=507846

His book on amazon.com (digital): http://www.amazon.com/exec/obidos/tg/detail/-/B00080JBL6/qid=1131287592/sr=8-2/ref=pd_bbs_2/103-4853314-0340604?v=glance&s=books&n=507846

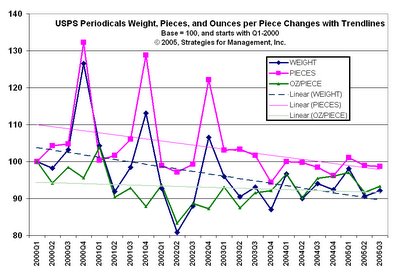

I've been working with postal shipments data recently. Here's a look at periodicals mailings compared to Q1-2000. Weight per piece is declining slightly (green line with light green trendline), the number of pieces is under Q1-2000 levels, but finally closing in (reddish lines), and the overall weight has suffered since Q4-2003 (the blue lines), which means that page counts are down. PIB and ABM have sounded upbeat in their press releases, but then you look at their data, and also these postal data, and you see the real story (make you feel you were a bait-and-switch victim). Beware data compared to just the prior period or just last year. When you sell consumables, that might be interesting, but when you sell technology or capital goods, or are considering significant investments that might not have payoffs for three to five years, slight pertubations are rather meaningless, and this chart does not evoke enthusiasm for market-changing investment. If anything, it creates more interest in consolidation.